Actionable insights are seamlessly delivered.

It surely comes as no surprise that now, in the digital world, banking industry is facing a paradigm shift. Customers expect seamless, personalized experiences tailored to their unique needs. This is easier said than done – most banks have digital solutions, but many are still far from being seamless and enjoyable for the consumer.

One of the ways banks can (finally) meet these expectations is by combining server driven UI with artificial intelligence (AI) to drive sales and optimize user experience (UX) in banking. In this post, we will discuss how these two technologies can work together to revolutionize the banking experience and create new opportunities for financial institutions.

What is Server Driven UI?

Server Driven UI (SDUI) is a design architecture that allows the server to control the user interface (UI) of an application. Instead of building static UIs for different platforms, the server uses UI components based on user input and other factors. This means that the UI can adapt to different devices, user preferences, and contexts without needing updates to the client-side code.

How Can AI Coupled with Server Driven UI enhance your Banking product?

AI can enhance server driven UI in several ways. We are going to focus on two aspects, one very important to users – user experience (UX) and the other important to banks – sales, and we are going to give a couple of examples for each of them.

- User experience (UX)

Server-driven UI enables dynamic updates to the user interface, allowing mobile applications to respond quickly to changes in user behavior or preferences. AI on the other hand can suggest optimizations based on user behavior or make corrections of user errors based on smart algorithms. Through optimization of the user interface it is possible to provide a better user experience.

Examples:

- Enhancing Customer Engagement:

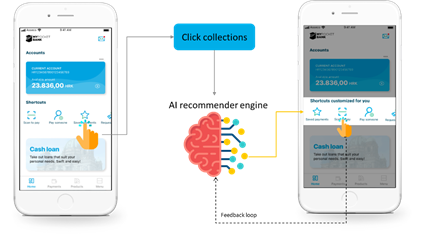

A personalized and adaptive UI can increase customer engagement by creating a more enjoyable and relevant experience. Engaged customers are more likely to explore additional banking products and services, leading to increased sales. By analyzing clicks, the AI can recommend the shortcuts that fit each customer, personalizing the app to their needs. For example, if a user frequently uses a certain feature in an application, the server-driven UI can optimize the interface to make that feature more prominent and accessible.

- Smart Search

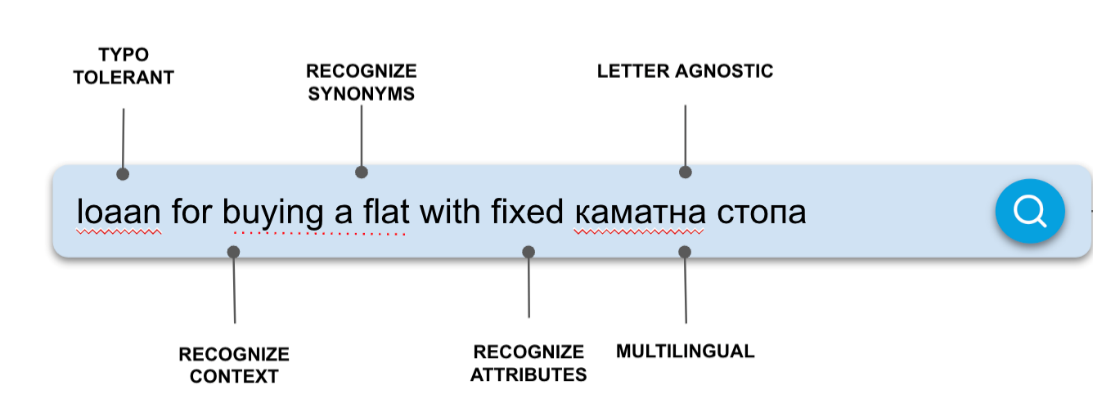

Searching through app highly depends on the quality of it. Miss a letter, or use a slightly different phrase, and the result is zero.

When powered by AI, search ensures that every user, while browsing, is equipped with an intelligent way to search the content or relevant information, thus freely expressing and formulating the inquiry or interest in some particular topic. In other words, it processes the input as a person would, increasing the chances of finding the right option.

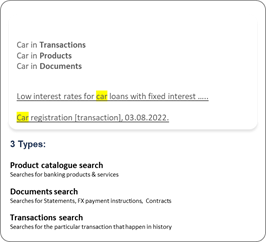

In a banking app, AI-powered search offers several types of searches:

and comes with many crucial functionalities: multilingual, letter agnostic, typo tolerant, recognizes synonyms, attributes, and have configurable training option:

- Sales and upsells

AI, together with server-driven UI, can boost sales by providing personalized recommendations and content to users based on their behavior and preferences. By using AI algorithms to analyze user data, mobile applications can suggest products, services, or content that are tailored to individual users’ interests, improving their overall experience. Here are some examples:

- Improved Customer Segmentation

Using AI, banks can more accurately segment their customers, tailoring marketing and communication efforts to target specific demographics better, leading to higher conversion rates and increased sales. In AI-powered campaigning, the system can identify customer segments that are more prone to taking cash loans, and launch a campaign to these specific individuals, with increased chances of conversion when compared to traditional “shotgun” advertising approach.

- Cross-Selling and Upselling Opportunities with Smart Recommendation and Segmentation

AI can identify cross-selling and upselling opportunities by analyzing customer data and suggesting relevant products or services, increasing revenue while also providing added value to customers. Thanks to Server Driven UI, it can deliver suggestions as an in-app ad, or through preferred correspondence method such as push notification, email or SMS. For example, by analyzing clicks, search queries or transaction data, the system might “think” a person could use a cash loan and display the banner right in the app, at the time the customer actually needs it.

- Reducing Customer Churn Through Proactive Support

AI can identify patterns of behavior that indicate a customer may be at risk of leaving. Banks can then proactively address concerns and offer solutions, increasing retention rates and improving customer satisfaction.

In conclusion, server-driven UI coupled with AI presents a powerful solution to drive sales and optimize UX in banking. By leveraging machine learning algorithms, banks can personalize the user experience, make personalized recommendations, and provide real-time insights and alerts. As technology continues to evolve, banks that embrace server-driven UI and AI will be well-positioned to meet the evolving needs of their customers and stay ahead of the competition.

Explore this topic today and contact us for a free consulting call.