No more manual pricing. Customer-oriented price determination with automatization based on your business needs.

Calculating service prices takes a lot of valuable time for employees, and slows down the sales, or time to money, for banking products. In addition to that, doing it manually can result in errors and risks and diminishes customer experience.

Introducing automated and personalized pricing engines can bring significant benefits, providing financial institutions with a powerful tool to drive sales, boost customer satisfaction, and stay competitive in a crowded marketplace.

Dynamic pricing supports sales teams with automated calculation of proper prices based on variable input parameters and gives them more time to become consultative sales representatives and not sales administration clerks.

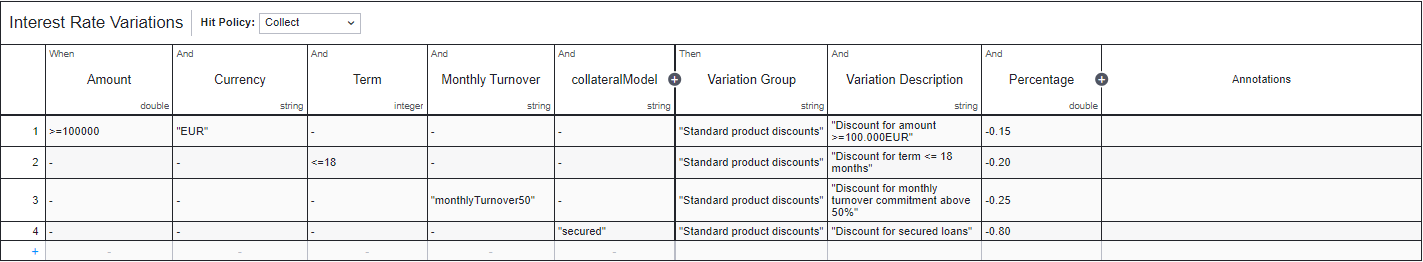

Based on flexible rules, consistently applied and transparently presented, all this is available to you with Digital Origination automated pricing calculation.

The automatization level is configurable on a banking product level and can be adjusted to your business needs. Apart from a fully automated price variations mechanism, Digital Origination supports price negotiations and manual correction of final conditions.

Some of the benefits of using Digital Origination automated customer-oriented pricing engine are:

Improved Customer Experience

Automated pricing engines offer customers a more personalized experience. By analysing specific data on individual customers, the engine can determine the most appropriate price for each customer based on the defined configuration. This helps to build a better relationship with the customer by showing that the bank cares about their individual needs and is willing to offer them customized solutions. Customers are more likely to be loyal to a bank that offers them a personalized experience and is willing to work with them to find the best financial products for their needs.

In addition, price calculation is done in real time, which ensures an efficient and comfortable customer experience.

Increased Efficiency

Automated pricing engine is faster and more efficient than manual pricing processes.

This can save banks a significant amount of time and money. Automated pricing engines also eliminate the possibility of human error, ensuring that pricing determination is accurate and consistent. This can help banks to avoid costly mistakes and improve overall efficiency.

Better Risk Management

Digital Origination pricing engine can also help banks to manage risk more effectively. Using customer data as input parameters for price calculation rules can help banks to make more informed decisions about lending and credit risk. By setting prices that are appropriate for the level of risk, banks can reduce the likelihood of default and improve their overall risk management.

Increased Revenue

Automated pricing engine can also help banks to increase revenue. By setting prices that are appropriate for each customer, banks can increase the likelihood of customers accepting offers. This can lead to increased sales and revenue for a bank.

On the other side, it can help banks to save money by reducing the need for manual price setting and analysis for each customer. This can free up resources, enabling banks to focus on other important areas of the business, such as customer service and product development.

Configuration Flexibility

Pricing engine configuration is highly flexible and allows banks to set prices based on a range of factors, such as customer segment, product type, arrangement amount and duration, financial profile, risk level, etc. This flexibility enables banks to tailor their pricing strategies to specific customer needs, ensuring that prices are always competitive and in line with customer expectations.

Conclusion

Automated and personalized pricing engine is a valuable tool for banks. It offers a lot of benefits, such as improved customer experience, increased efficiency, better risk management, increased revenue, and competitive advantage.

As technology continues to advance, automated pricing engines will become a standard if a bank wants to remain competitive in the market. To find out more about how dynamic pricing can improve your banking sales contact us for a free consulting call today.